Goods & Service Tax (GST)

We provide complete GST advisory & Compliances services including registrations, returns, tax advisory & GST Audits to businesses in India

GST SERVICES

GST Registration - Eligibility, Process and Expert Help

GST is the biggest tax reform in India, tremendously improving ease of doing business and increasing the taxpayer base in India by bringing in millions of small businesses in India. By abolishing and subsuming multiple taxes into a single system, tax complexities would be reduced while tax base is increased substantially. Under the new GST regime, all entities involved in buying or selling goods or providing services or both are required to register for GST. Entities without GST registration would not be allowed to collect GST from a customer or claim an input tax credit of GST paid and/or could be penalised. Further, registration under GST is mandatory once an entity crosses the minimum threshold turnover of starts a new business that is expected to cross the prescribed turnover

GST Turnover Limit

There are various types of GST registration and some types of entities like casual taxable persons, non-resident taxable persons or persons supplying through eCommerce operators are required to mandatorily obtain GST registration irrespective of turnover limit. The GST turnover limit for regular GST registration for service providers and goods supplier is provided below.

Service Providers: Any person or entity who provides service of more than Rs.20 lakhs in aggregate turnover in a year is required to obtain GST registration. In special category states, the GST turnover limit for service providers has been fixed at Rs.10 lakhs.

Goods Suppliers: As per notification No.10/2019 any person who is engaged in the exclusive supply of goods whose aggregate turnover crosses Rs.40 lakhs in a year is required to obtain GST registration. To be eligible for the Rs.40 lakhs turnover limit, the supplier must satisfy the following conditions:

- Should not be providing any services.

- The supplier should not be engaged in making intra-state (supplying goods within the same state) supplies in the States of Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikkim, Telangana, Tripur and Uttarakhand.

- Should not be involved in the supply of ice cream, pan masala or tobacco.

GST compliance

GST has been implemented in India from 1st July, 2017. Under the new GST regime, over 1.3 crore business in India have been registered and issued GST registration. All entities having GST registration are required to file GST annual returns, as per the GST return due date schedule mentioned below. GST annual return filing is mandatory for all entities having GST registration, irrespective of business activity or sales or profitability during the return filing period. Hence, even a dormant business that obtained GST registration must file GST return.

GST registration holder who obtained the registration anytime before 1st April 2018 are required to file GST annual return for the financial year 2017-18 on or before 30th June 2019. Before filing GST annual return the taxpayer must have filed all GSTR-1 or GSTR-3B or GSTR-4 return for the period of July to March 2018. In case there are overdue GST returns for the above-mentioned period, the GST registration holder will not be allowed to file GST annual return.

GST compliance Types

GST compliance Filing can be divided into three types based on the form to be filed as under:

- GSTR-9: All entities having GST registration are required to file GST annual return in form GSTR-9.

- GSTR-9A: GST registered taxpayers who have opted for the GST Composition Scheme under Goods and Services Tax (GST) are required to file GSTR-9A.

- GSTR-9C: Form GSTR 9C is meant for filing the reconciliation statement of taxpayers pertaining to a particular financial year. The form is a statement of reconciliation between the Annual Returns in GSTR-9 and the figures mentioned in the Audited Financial Statements of the taxpayer.

GST Return Filing

GST has been implemented in India from 1st July, 2017. Under the new GST regime, nearly 1 crore busineses in India have obtained GST registration. All entities having GST registration are required to file GST returns, as per the GST return due date schedule mentioned below. GST return filing is mandatory for all entities having GST registration, irrespective of business activity or sales or profitability during the return filing period. Hence, even a dormant business that obtained GST registration must file GST return.

GST registration holder are required to file GSTR-1 (details of outward supplies) on the 10th of each month, GSTR-2 (details of inward supplies) on the 15th of each month and GSTR-3 (monthly return) on the 25th of each month. Dealers registered under the GST composition scheme are required to file GSTR-4 every quarter, on 18th of the month next to the quarter. Finally, annual GST return must be filed by all GST registered entities on/before the 31st of December. The due dates for the GST return due in July, August and September are different from the normal schedule to help the taxpayers and GSTN network ensure a smooth GST rollout.

R.K. & Associate is the leading business services platform in India, offering end to end GST services from registration to return filing. R.K. & Associate can help you file GST returns in India. The average time taken to file a GST return is about 1 - 3 working days, subject to government processing time and client document submission. Get a free consultation on GST return filing by scheduling an appointment with an R.K. & Associate Advisor.

GST Input Tax Credit Reconciliation

GST is an indirect tax levied on goods and services based on the principle of value addition. Hence, the levy of tax is based on the value added at each stage of the supply chain till the product or service reaches the ultimate consumer. In such a tax system, to negate the cascading effect of the tax, there exists a means to set of taxes paid on procurement of raw materials, consumables, plant and machinery, equipment, services, etc., that are used for the manufacturing or supply of goods and services. This element used to offset the tax liability is called input tax credit.

Eligibility for Claiming Input Tax Credit

Input tax credit can be claimed only by a person having GST registration and based on proper documentation and filing of GSTR-2 returns. The following documentary requirements must be satisfied by a taxpayer for claiming input tax credit.

- An invoice issued by the Supplier as per the GST Rules for Invoice

- A debit note issued by a supplier

- A bill of entry or any similar document

- An ISD invoice or ISD credit note or any document issued by an Input Service Distributor.

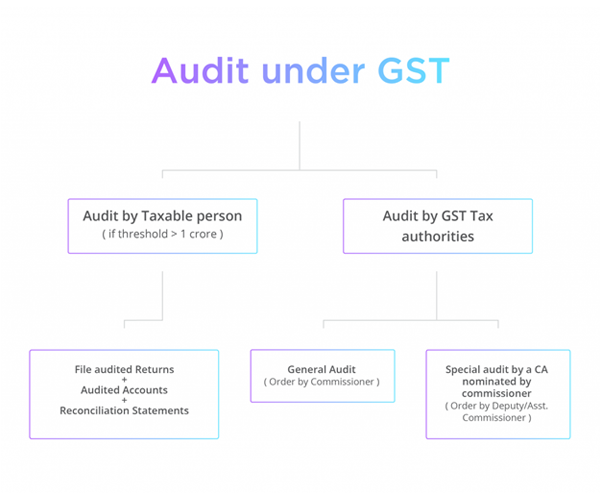

Audit Under GST

Audit under GST is the process of examination of records, returns and other documents maintained by a taxable person. The purpose is to verify the correctness of turnover declared, taxes paid, refund claimed and input tax credit availed, and to assess the compliance with the provisions of GST

Audit under GST is the process of examination of records, returns and other documents maintained by a taxable person. The purpose is to verify the correctness of turnover declared, taxes paid, refund claimed and input tax credit availed, and to assess the compliance with the provisions of GST.

Threshold for Audit

Every registered taxable person whose turnover during a financial year exceeds the prescribed limit [as per the latest GST Rules, the turnover limit is above Rs 1 crore] shall get his accounts audited by a chartered accountant or a cost accountant. He shall electronically file:

- an annual return using the Form GSTR 9B along with the reconciliation statement by 31st December of the next Financial Year

- the audited copy of the annual accounts,

- a reconciliation statement, reconciling the value of supplies declared in the return with the audited annual financial statement,

- and other particulars as prescribed.

Rectifications after Return Based on Results of Audit under GST

If any taxable person, after furnishing a return discovers any omission/incorrect details (from results of audit), he can rectify subject to payment of interest. However, no rectification will be allowed after the due date for filing of return for the month of September or second quarter, (as the case may be), following the end of the financial year, or the actual date of filing o the relevant annual return, whichever is earlier.

For example, X found during audit that he has made a mistake in Oct 2017 return. X submitted annual return for FY 2017-18 on 31st August 2018 along with audited accounts. He can rectify the Oct 2017 mistake within- 20th Oct 2018 (last date for filing Sep return) or 31st August 2018 ( the actual date of filing of relevant annual return) -earlier, ie., his last date for rectifying is 31st August 2018.

This rectification will not be allowed where results are from scrutiny/audit by the tax authorities.

Audit by Tax Authorities

- The Commissioner of CGST/SGST (or any officer authorized by him) may conduct audit of a taxpayer. The frequency and manner of audit will be prescribed later.

- A notice will be sent to the auditee at least 15 days before.

- The audit will be completed within 3 months from date of commencement of the audit.

- The Commissioner can extend the audit period for a further six months with reasons recorded in writing.

Obligations of the Auditee

The taxable person will be required to:

- provide the necessary facility to verify the books of account/other documents as required

- to give information and assistance for timely completion of the audit.

Findings of Audit

On conclusion of an audit, the officer will inform the taxable person within 30 days of:

the findings, their reasons, and the taxable person’s rights and obligations

If the audit results in detection of unpaid/shortpaid tax or wrong refund or wrong input tax credit availed, then demand and recovery actions will be initiated.

GST TOOLS

GST Registration - Eligibility, Process and Expert Help

GST eWay Bill is a document for tracking of goods in transit introduced under the Goods and Services Tax. Under GST, a taxable person registered under GST transporting goods with a value of over Rs.50,000 is required to possess an eWay Bill generated from the GST Portal. LEDGERS can make eWay Bill generation and management simple for your business. The LEDGERS eWay Bill tool is synced to GST invoices, bill of supply, purchase invoices and customer or supplier accounts. So you can now seamlessly at the click of a button generate eWay Bill and share with your customers or suppliers.

eWay Bill Requirement

GST eWay bill is required for the following cases where in a person having GST registration is causing movement of goods:

- If a taxable person under GST supplies any goods and the value of the consignment is over Rs.50,000, a GST EWay Bill would have to be generated.

- If a taxable person under GST transfers goods located in one godown to another and the value of the consignment is over Rs.50,000, a GST EWay Bill need to be generated.

- If a taxable person under GST purchases any goods from an unregistered person under GST and the value of the consignment is over Rs.50,000 a GST EWay Bill should be generated.

Software 1

Rk& Associate offers the GST billing software for small & Medium Enterprises to create their Invoicing & prepare GST returns easily. With the introduction of the GST, the general perception has been one of increased difficulty in creating invoice. With this GST software for traders and GST accounting software, you can make sure that you never have to break a sweat in order to file your returns!

Our Features

GST Reporting

Rk& Associate’s online GST software helps make GST reporting easier for both sellers and buyers. Buyer sales are automatically recorded as your purchases, making things convenient for GST reporting.

GST Filling

All it takes to file your GST throughGST billing software by Rk& Associatedownloading your sales& Purchase data and uploading in our enterprises software Tally or Busy! Rk& Associate’s GST billing software takes care of the rest.

Sales Management

A key feature in any GST accounting software is sale management. Rk& Associate’s GST invoice software allows you to manage sales and taxes all in one environment.

Purchase Management

Where there are sales, there are purchases. What better way than to manage both under one single umbrella? Rk& Associate’s online GST software allows you the freedom to do so!

Accounting Management

The best part about Rk& Associate’s GST software for traders is that it helps manage the books simply by a click of the mouse. The software are designed for all traders and retailers, making their lives easier

Outstanding Report

If you ever have any outstanding reports for GST filing, the software will notify you and make sure that all returns are filed.

Core Features of GST Software

Accounting Management

For traders and retailers, accounting management is an integral part of the process. Spine’s GST accounting and invoice software help traders manage their books and keep them up to date with the touch of a button.

GST Filling

With Rk& Associate’s GST software for traders, filing of returns is now a piece of cake. All you need to do is upload your sales and buyer information on the website, and Rk&Associate’s will use Enterprises software Tally or Busy will take care of the rest. Once all is said and done, you can verify the monthly returns calculated, and voila! That’s it!

Purchase Management

An effective GST software for traders allows them to manage purchases conveniently and within a single platform as their other operations. Software gives you this convenience, with its cloud based GST software helping traders and retailers manage all purchase information at one place.

Sales Management

With purchase management, comes sales management as well. Rk& Associate’s GST reporting software makes sure that your team works hard on closing sales, and not managing or logging them into the system. All it takes is two clicks of the mouse, a little information, and your sales are managed!